Introduction

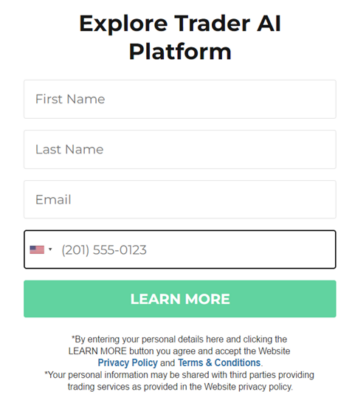

In the realm of cryptocurrencies and finance, DeFi and Bitcoin have been creating waves. The first and best-known cryptocurrency, Bitcoin, has been active for more than ten years and has developed a sizable following. Contrarily, DeFi is a relatively recent idea that seeks to challenge conventional banking by providing decentralized financial services. In this essay, we’ll look at how Bitcoin and DeFi interact and consider how they can reshape the banking sector. This essay will provide you a thorough grasp of Bitcoin and DeFi and their ability to influence the future of finance, regardless of whether you are an experienced crypto investor or a beginner. If you are starting on crypto trading try, It is an amazing online trading platform for a seamless trading experience.

Bitcoin and DeFi: The Future of Finance

Mass Adoption

Future adoption of Bitcoin and DeFi has the potential to be significant. We may observe a shift away from traditional financial services and toward these decentralized alternatives as more people learn about the advantages of utilizing Bitcoin and DeFi.

Disrupting Traditional Finance

Bitcoin and DeFi have the ability to upend conventional finance and put established financial institutions’ hegemony in jeopardy. Decentralized and transparent borrowing, lending, and trading are just a few of the financial services that DeFi systems provide.

Improved Regulations

We may anticipate increasing regulation and supervision as Bitcoin and DeFi gain popularity. For users of these sites, this could increase security and stability and help deter fraud and other criminal behavior.

Integration with Traditional Finance

The combination of Bitcoin, DeFi, and conventional financial services may increase in the future. Some traditional financial institutions are already investigating the usage of cryptocurrencies and blockchain technology, and we may see greater cooperation between these sectors in the future.

The Advantages of Bitcoin and DeFi

Lower Transaction Fees

One of the major advantages of using Bitcoin and DeFi is lower transaction fees compared to traditional financial services. Traditional financial institutions charge high transaction fees for international money transfers and other financial transactions.

Increased Security and Privacy

Blockchain technology, which is the foundation of both Bitcoin and DeFi, increases user security and privacy. Users’ confidence in the financial system is improved because to the security and immutability of transactions on the blockchain.

Financial Freedom and Independence

Another advantage of Bitcoin and DeFi is the potential for financial freedom and independence. Traditional financial systems are often centralized and controlled by a few large institutions. Bitcoin and DeFi, on the other hand, are decentralized and provide users with greater control over their finances.

The Future of Bitcoin and DeFi

Despite being relatively young technologies, Bitcoin and DeFi have already had a big impact on the banking sector. With numerous experts expecting ongoing growth and improvement in the upcoming years, the future of Bitcoin and DeFi appears bright.

Increased Adoption

One of the key factors that will determine the future of Bitcoin and DeFi is increased adoption. As more people become aware of these technologies and their potential benefits, we can expect to see more widespread adoption of Bitcoin and DeFi.

Improved Scalability

Scalability has been a challenge for Bitcoin and DeFi, but there are ongoing efforts to address this issue. DeFi platforms are also exploring ways to improve scalability, such as by using layer 2 solutions like zk-rollups.

Greater Interoperability

Interoperability is another area that is likely to see significant development in the future of Bitcoin and DeFi. As more DeFi platforms are built on different blockchains, there is a need for greater interoperability between these platforms.

Mainstream Integration

In the future, we can expect to see greater integration of Bitcoin and DeFi into mainstream financial services. Traditional financial institutions are already exploring the use of blockchain technology and cryptocurrencies, and we could see more collaboration between these industries in the future.

Continued Innovation

Finally, the future of Bitcoin and DeFi is likely to be characterized by continued innovation. Developers are constantly working on new and exciting projects in the Bitcoin and DeFi space, and we can expect to see more innovative financial products and services emerge in the coming years.

Conclusion

According to the article’s end, Bitcoin and DeFi are the future of cryptocurrencies and provide cutting-edge methods for managing money and gaining access to financial services. Utilizing these technologies has benefits such as reduced costs, improved accessibility, and increased security. Before making a Bitcoin investment or utilizing a DeFi platform, it’s crucial to be aware of any associated dangers. With the potential for more acceptance, enhanced scalability, increased interoperability, mainstream integration, and ongoing innovation, Bitcoin and DeFi have a promising future. Overall, these technologies have the ability to upend conventional finance and provide individuals all around the world more financial independence and freedom.